It’s a scene playing out in boardrooms across Bengaluru. The quarterly review was in full swing, and the usual metrics like utilisation rates, time-to-market, and cost efficiency, were on the screen. But then, a new chart appears: carbon footprint per project delivered. This isn’t just a sidebar; it’s a clear signal that sustainability has moved from a corporate social responsibility (CSR) talking point to a core business expansion strategy.

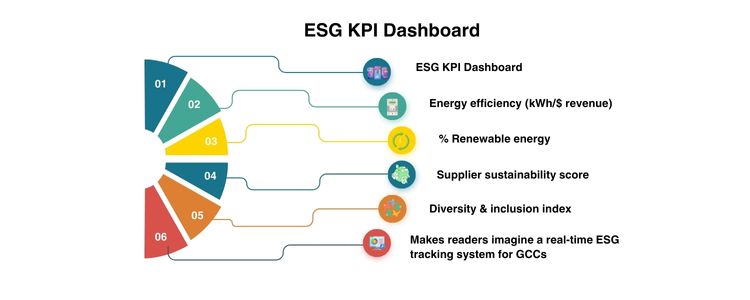

For years, Global Capability Centres (GCCs) have focused on operational and financial metrics. The goal was simple: deliver faster, cheaper, and at higher capacity. The environmental and social impact of these targets was rarely a factor. However, nothing is the same anymore. The most innovative GCCs are currently adopting a more progressive set of metrics which covers the environmental, social and governance factors (ESG). Here is how traditional KPIs are becoming ESG-integrated ones:

This shift isn’t happening in a vacuum. A perfect storm of client demands, regulatory changes, and investor pressure is making ESG a competitive necessity.

To integrate ESG, the following four-step journey has been proving successful to GCCs:

Beyond the traditional financial metrics, these are the new numbers driving success:

It is not only a conceptual change but also a practical change to ESG that is currently taking place:

It is estimated that India’s GCC sector will realise more than $100 billion in revenue and 2.8 million direct jobs by 2030, with a potential of 2 per cent of Indian GDP. Among the GCCs that will show this growth are the ones that embed ESG into their core strategy. They will be in better positions to pursue high-valued international contracts, access to high-calibre human resources, as well as favourable funding.

We foresee that AI-enabled ESG dashboards will become commonplace to track both market expansion strategy compliance and performance in real time. The cities with increased renewable energy capability can also become the citadels of ESG-preferred GCC clusters, further establishing India as the destination of next-generation captive centers. ESG is no longer merely a compliance box. It is the latest currency of the competitive advantage. Leaders of the future will not only provide results but will provide them with a clear conscience, a carbon label and a diversity badge.

A GDC refers to a single-minded offshore deployment, which provides proficient business, technology and operational services to corporate bodies on a global basis. BFSI, IT services, healthcare, telecom, retail, manufacturing, and other upcoming technologies, including AI and blockchain. They do not only target cost savings but now aim at innovation, automation, R&D, digital transformation, and high-value consulting. They design and create cloud, artificial intelligence, analytics, cloud security, and process automation. A large supply of STEM graduates, multilingual workers and niche skills in AI, ML, cloud, and analytics. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

From Old KPIs to a New World of ESG

Why ESG Is Now Business-Critical for GCCs

A New And Updated Playbook On GCC Leaders

The Numbers Game: Metrics That Matter Now

Metric

What It Measures

Why It’s Strategic

Energy Efficiency Ratio

Kilowatt-hours per dollar of revenue

Reduces operational costs and emissions, a key factor in global tenders.

Emissions Intensity

CO₂e per FTE

Enhances brand positioning and helps win contracts with sustainability-focused clients.

Water Usage per Project Cycle

Litres per project

Helps meet climate resilience targets and manage a critical resource.

Diversity Impact Index

Leadership mix by gender and background

Improves talent retention, fosters innovation, and strengthens brand reputation.

Circularity Rate

Percentage of assets reused/recycled

Lowers waste, reduces procurement costs, and supports a circular economy.

Real-World Wins

What Next: ESG as the Competitive Edge

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025