In 2025, global enterprises are no longer raising the question of whether to invest in ESG but how quickly they can apply it to their operations. According to a survey, 97% of institutional investors say that companies will have to hasten the implementation of their ESG strategy to remain competitive. Entry of India’s global capability centers (GCC) is a hidden engine that carries forward this change. India employs more than 1,900 GCCs and is contributing $64 billion annually to the economy; these centers are becoming a command center for fast enterprise-wide ESG implementation.

India’s GCCs are no longer the centers of excellence; they are the centers of permanent professional operation, including cost profit, green technology and domain-based ESG compliance expertise. GCC is now: Real effects: The increase in ESG roles is expected to grow at a rate of 23% annually by 2030. ESG integration is no longer alternative—it is a motivator of revenue, flexibility and reputation.

– Workload shifting to green data centers – Serverless and containerised applications for reduced energy – Climate scenario planning using TCFD/ISSB models – Automation of ESG disclosures in annual filings – Water and energy usage dashboards across manufacturing units – Real-time ESG scoring for vendors and portfolios – DEI scorecards tied to leadership KPIs – Community engagement through upskilling tribal and rural youth – Compliance with Modern Slavery Acts, GHG Protocols – Anti-corruption reporting systems for ethical sourcing ESG is no longer a separate area. This is a shared mandate, which is inherent in each team and contact point within the future-centric GCC.

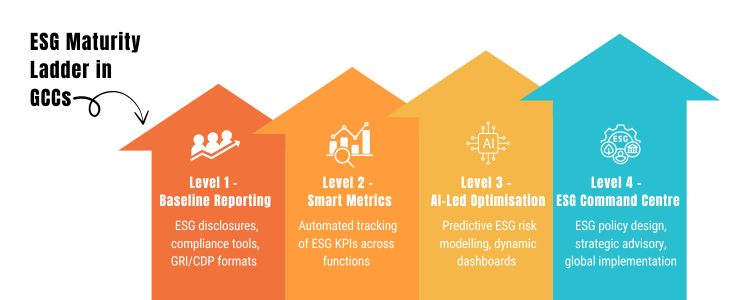

We use a 4-level ESG maturity ladder to help global firms move from basic compliance to ESG innovation:

In the Inductus GCC, we extend the enterprises to level 4 to make ESG a main pillar of long-term commercial changes.

Cost efficiency with high-influence results: The role of the US -based ESG analyst is 2.4 times more expensive than a similar role in India. But Indian GCCs not only provide strength but also bring scalable ESG innovation. Talent availability and skill readiness: More than 700,000 professionals in India are now skilled in ESG-relevant sectors, including Green Finance, Data Governance and Climate Modeling. Policy alignment: India aims to achieve net zero emissions by 2070, and to cut carbon intensity by 45% by 2030 – which will make its regulatory landscape ESG -supporter and future-oriented.

Each of these initiatives shows how GCC is the promoter of global ESG narratives, not only the processor of compliance data.

Despite the progress, three major challenges remain: To solve this problem, we enable the following:

Over the next 3 years, GCC will serve as ESG OS (operating system) with integrated governance, automation and strategic foresight capabilities. India’s offshore centers will no longer be implemented branches—they will be the decision engine for ESG strategy.

“Sustainability without execution is a strategy without a soul. That’s why GCCs matter.” In Inductus GCC, we do not only make teams—we make durable, scalable ESG-ready digital ecosystems for the world’s most responsible enterprises. From the Green Tech platform to ESG strategy implementation and ESG talent management in offshore teams, we help to incorporate the purpose of global businesses in every process.

GCC serves as operating centers for ESG implementation, ESG data analysis, compliance reporting, stability dashboard, DEI initiatives and green technology managing finance, helping global enterprises to implement ESG strategy. GCC includes carbon-inconvenient cloud infrastructure, energy-skilled computing, renewable energy-operated data centers and low-emissions designs in GCC. These enterprises enable measuring decrease in carbon footprints. The offshore ESG talent ensures that stability, morality and governance are built in daily tasks. GCCs in India are building DEI-based teams, ESG Kaushal academies and leadership development programs to meet global compliance and purpose goals. GCC takes advantage of AI and ML to forecast emissions, to track ESG KPIs, and to make climate risk models. These analyses empower ESG reporting, green investment decisions and real-time stability monitoring throughout the enterprise. GCCs use structured maturity stairs from compliance to strategic coordination to increase organisational ESG readiness—ESG operating systems implement platforms, risk modelling, green innovation laboratories and DEI regimes. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

ESG Development of GCC

Role-Based ESG Integration: A Capability View

GCC Function

ESG Enablement

Initiatives & Real-World Examples

Cloud & Infrastructure Engineering

Green technology in GCCs

– Carbon-aware cloud architectures using tools like Microsoft Sustainability Manager

Finance & Risk Teams

ESG strategy implementation

– ESG-linked lending frameworks and impact-weighted accounting

Data Science & Analytics

Sustainable business operations

– Scope 1/2/3 emissions forecasting using ML

HR, DEI & Talent Management

ESG talent management in offshore teams

– Diversity targets by design: gender, PWD, and LGBTQ+ hiring programmes

Procurement & Legal

GCCs and ESG compliance

– Vendor ESG screening using blockchain-led traceability

GCC and ESG Maturity ladder

Why is India ESG's Ideal Implementation Engine?

Global Examples

ESG In GCC

Future ESG Operating System

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025