India is fast becoming the world leader when it comes to the establishment of Global Capability Centres (GCCs). The presence of the GCC sector in FY25 implies USD 241 billion worth of GCC-related outputs, value-additions along supply chains, and induced consumption to India as a result of the activity. The nation has been predicted to reach above one hundred billion US dollars by 2030 thus indicating that it is a leader in the sector.

The states are competing to be the new GCC hotspot in India through their relative performance in the following areas:

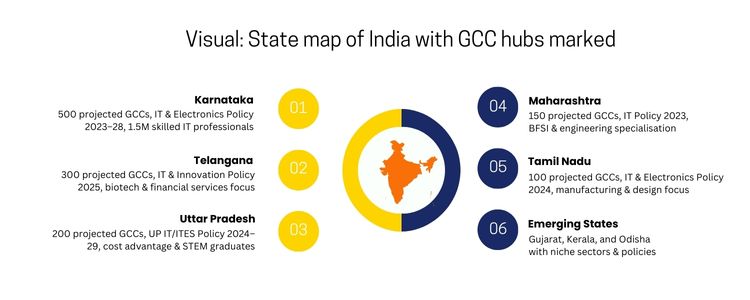

1. Karnataka (Bengaluru) 2. Telangana (Hyderabad) 3. Uttar Pradesh (Lucknow) 4. Pune (Maharashtra), Mumbai 5. Tamil Nadu (Coimbatore & Chennai)

Different Indian states are deploying numerous mechanisms to attract GCCs:

The evolving environment presents:

There is a growing battle between the states in India to emerge as the next hotspot destination in the GCC. These states are a force to be reckoned with, as they have the strategy, a strong policy implementation and the vision toward infrastructure that is likely to change the global GCC environment. This is an opportunity for businesses because they will be poised to locate to the correct region, which will lead to growth and operational excellence in the next decade.

The rivalry between Indian states to become the next GCC hot spot is turning the country into an innovation and high-value service hub. Said growth is being spurred by strategic policies, pools of talent, strong and effective infrastructures, and cost advantages. States such as Karnataka, Telangana, and Maharashtra are ahead and emerging players like Gujarat and Kerala are cutting niche opportunities. Businesses interested in establishing GCCs in India can make informed decisions, optimise their investments, and achieve long-term operational sustainability by being aware of the strengths of each state in the GCC industry in India.

Tap the complete potential of the Indian GCC ecosystem in your business expansion with Inductus GCC. Get information on advantages, policies and talent opportunities state-wise in order to strategically locate your offshore development center. Contact Us now and set up your GCC in India, the most advantaged place to succeed, advance and achieve operation perfection.

A GDC refers to a single-minded offshore deployment, which provides proficient business, technology and operational services to corporate bodies on a global basis. BFSI, IT services, healthcare, telecom, retail, manufacturing, and other upcoming technologies, including AI and blockchain. They do not only target cost savings but now aim at innovation, automation, R&D, digital transformation, and high-value consulting. They design and create cloud, artificial intelligence, analytics, cloud security, and process automation. A large supply of STEM graduates, multilingual workers and niche skills in AI, ML, cloud, and analytics. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

What is A GCC Hotspot?

The Leading Runners

The Strategies: How the States are positioning themselves

The League Table: Future Predictions

State

Projected GCCs by 2030

Key Strengths

Policy Highlights

Talent Pool

Infrastructure & Connectivity

Projected Job Creation

Karnataka

500

IT & R&D leadership

IT & Electronics Policy 2023–28: capital subsidies, fast-track approvals, R&D incentives

1.5M skilled IT professionals

Bengaluru IT parks, airports, metro, robust digital infra

350,000

Telangana

300

Financial services & biotech

IT & Innovation Policy 2025: tax reductions, grants, labour law support, start-up incubation

0.9M graduates in tech & biotech

Hyderabad HITEC City, outer ring road, international airport

200,000

Uttar Pradesh

200

Cost efficiency & education

UP IT/ITES Policy 2024–29: capital reimbursement, payroll subsidies, subsidised land

2.0M STEM graduates annually

Noida & Lucknow IT parks, high-speed rail, metro expansions

150,000

Maharashtra

150

BFSI & engineering GCCs

Maharashtra IT Policy 2023: tax exemptions, GCC parks, logistics corridors

1.2M engineers & finance graduates

Pune & Mumbai IT/industrial corridors, international airport, highways

100,000

Tamil Nadu

100

Manufacturing& design focus

IT & Electronics Policy 2024: land subsidies, R&D incentives, industry-academia collaboration

0.8M skilled IT/ manufacturing workforce

Chennai & Coimbatore IT parks, ports, metro, industrial corridors

80,000

Gujarat (Emerging)

70

Manufacturing & innovation

Gujarat IT Policy 2025: capital subsidies, innovation grants, tax breaks

0.5M skilled workforce

Special IT zones, ports, highways, digital infra

50,000

Kerala (Emerging)

50

Niche sectors (AI & analytics)

Kerala IT Policy 2024: R&D incentives, tax breaks, incubator support

0.3M skilled graduates

Cyberpark & InfoPark, improved connectivity to airports

30,000

Odisha (Emerging)

40

Minerals & analytics

Odisha IT Policy 2025: land grants, fiscal incentives, startup support

0.25M graduates

Bhubaneswar IT parks, smart city initiatives

20,000

What It Implies For Businesses

Upcoming Opportunities

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025