There is a structural change, where mid-sized Global Capability Centres (GCCs) are beating larger peers in terms of hiring velocity, rate of innovation throughput and time-to-value. India has a robust GCC flywheel (1,800+ GCCs, 1.9M employees and $65B+ direct revenue) of FY2024 with a potential 40-70% operating cost savings relative to developed markets, providing enterprises with a foundational base to rewire global operating models. In addition to direct output, the overall economic impact of the sector was $241B in FY25 (direct, supply chain and induced effect), reinforcing India as an economic macro leader to establish an offshore development center or multi-function hub.

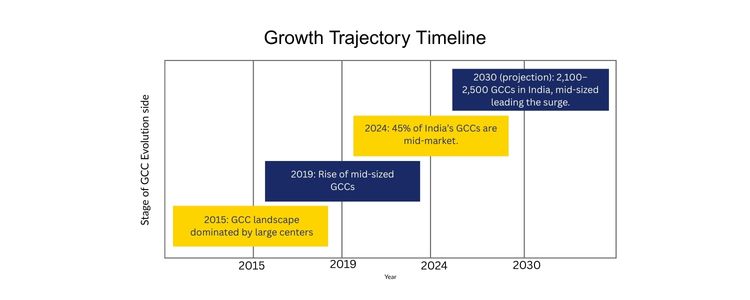

Larger GCCs bear cumbersome hierarchies; mid-sized units feature flat squads and product pods, which allow them to make pivots more swiftly. The number of mid-sized GCCs in GCC has increased by 46 per cent in five years to more than 220k (2019-2024), outpacing their larger counterparts in scale. India currently has 1,900 GCCs, including forty-five per cent belonging to the mid-market segment, and is estimated to add more than 120 mid-market GCCs in the near future. Lesson: Organise around small cross-functional pods (product, design, data, cloud) with KPIs that are relevant to the P&L. Large centers tend to internalise; medium-sized GCCs co-create with startups, research universities and partner organisations to reduce cycle time. India has deep tech hubs in Bengaluru, Hyderabad, Pune, Chennai, NCR and pro-GCC state policies. Suggestion: Construct a partner map in AI tooling, AI security, and Domain accelerators; portfolio diversification via tier-1/2 city cum cluster in India. Big logos will attract by definition; mid-sized ones carry the culture engineering advantage that will be visible leadership cells; fast-track growth; and innovation awards. India has 2-5x more talent concentration at 50 per cent cheaper costs: UK firms by themselves operate 250+ GCC units in India. Suggestions: Build career lattices (IC and leadership ladders), post public roadmaps of skill sets, and finance 10 per cent time experimentation. Big centers are the ones that are good at process, at product ownership and at customer-back metrics, which are owned by the mid-sized centers. Indian GCCs are already creating ~1 percentage point of the Indian GDP and are expected to grow at a higher level in the future – a clear indication of outcome orientation as a means of enhancing enterprise value. Lesson: Conclude shifting the governance focus to business outcomes (revenue influence, conversion, NPS, release cadence). Legacy models were built on real estate; mid-sized GCCs are cloud-native with AI-first and remote-ready. Sources estimate 2,100-2,500+ GCCs by 2030/the next 3-4 years, as companies increase their digital work in India and employ 450,000 new workers in 2025. Lesson: Standardise platform engineering, FinOps, and MLOps; make GenAI and automation force multipliers in regard to throughput and cost.

Cost benefit: Operating a GCC in India results in 40-70 per cent cost savings; multi-port options (e.g., Pune, Hyderabad and Jaipur) will optimise TCO. Scale and momentum: 1,900+ capability centres with an anticipated headcount by the end of 2022 of nearly 1.9M in 15+ markets, and surging mid-sized growth in India that continues to attract large volumes of digital, product engineering and analytics talent across the GCC. Macro impacts and policy tailwinds: $241B total economic impact in FY25, favourable SEZ/IFSC/state policy, and maturing innovation ecosystems, increasing the addressable pie available to GCC companies in India and enterprise adoption of GCC best practices for enterprises.

Mid-sized GCCs are no longer the laggards; they are the leaders when it comes to agility, innovation and low costs that are being experienced on a global scale. These centers show how companies can achieve a faster and smarter scale in a nation with a large pool of talent and an able ecosystem plus policies to support the growth. Firms planning worldwide cloning can use the mid-sized GCC model as a handy guideline of sorts – future-ready, digital-first, and outcome-driven. The moral is obvious for the future of globalisation of businesses: the flexibility and solidity of small entities will be the next global trend to be set by business enterprises of international calibre.

At Inductus GCC we assist enterprises to design, construct and grow agile Global Capability Centres in India. We provide quicker time-to-value through location strategy, talent design and AI-first operational practices. Team with us to re-engineer your GCC into a veritable growth engine of global success.

A GDC refers to a single-minded offshore deployment, which provides proficient business, technology and operational services to corporate bodies on a global basis. BFSI, IT services, healthcare, telecom, retail, manufacturing, and other upcoming technologies, including AI and blockchain. They do not only target cost savings but now aim at innovation, automation, R&D, digital transformation, and high-value consulting. They design and create cloud, artificial intelligence, analytics, cloud security, and process automation. A large supply of STEM graduates, multilingual workers and niche skills in AI, ML, cloud, and analytics. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

The Playbook: Conflict & Lessons

Large vs. Mid-Sized GCCs

Axis

Large GCCs (Typical)

Mid-Sized GCCs (Observed)

Action for Enterprises

Org structure

Multi-layered

Flat squads/pods

Create 10–15 person pods tied to business outcomes.

Build strategy.

In-house heavy

Partner-led co-creation

Formalise startup/ISV alliances and university labs.

Talent model

Brand pull

Culture pull

Codify skill taxonomies, visible leadership & fast tracks.

Metrics

SLA/process

Product/Customer

Move to OKRs: revenue influence, NPS, release velocity

Scale motion

Real estate first

Digital-first

Cloud-native stacks, AI/automation as default

Economic Benefits of India

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025