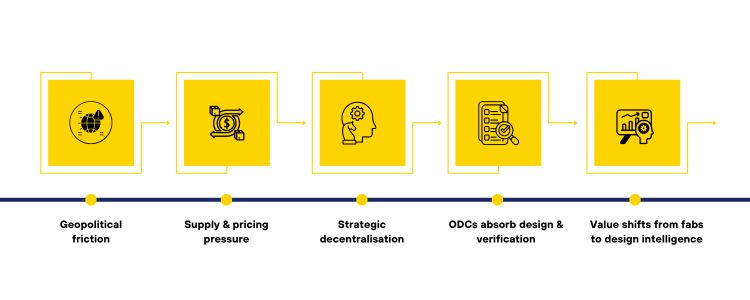

The demand for semiconductors is skyrocketing on a global level, and the figures testify to it. The industry was recording about US $627 billion in 2024 and analysts are forecasting almost US $697 billion in 2025, which is fuelled by AI, data centres and automotive electrification. The market has registered approximately US$346 billion in H1, an increase of nearly 19% year-on-year, at the middle of 2025, with quarterly sales on the rise. The following macro shifts are the immediate context of the way Offshore Development Centers (ODCs) are repositioning in Asia and Eastern Europe. A brief history: The chip piping was constrained by geopolitics; design and software were strategically positioned; and multinational corporations started transferring chip expertise to neutral areas (ODCs). This is not a complicated chain, yet the consequences in the automotive and electronics offshore development are great and long-term.

Some advanced AI and inference chips have been restricted since 2023–2024 because of export restrictions and national chip sovereignty campaigns, particularly between the United States and China. OEMs and consumer electronics companies that use advanced silicon are protected from increased compliance risk and supply uncertainty. As a result, companies began to decentralise embedded systems, semiconductor design, EDA work, and manufacturing footprints to geopolitically neutral ODCs. The Reasons Automotive and Electronics Are Key The ADAS, powertrains, and infotainment systems of modern automobiles contain thousands of semiconductors and increasingly complex SoCs. Scale AI and sensor requirements are necessary for consumer electronics. When there is a shortage of chips, R&D schedules, firmware releases, and model testing lag, and revenues and safety are compromised. ODC footprints are expanding to automotive and electronics R&D teams today because of that domino effect. Cost Centres Into Strategic Design Nodes Offshore Development Centers are no longer solely involved in coding or testing. The major automotive and electronic firms are outsourcing system-level chip design, silicon validation, hardware-software co-design and firmware integration to ODCs based in India, Poland, Vietnam, and Mexico. This is driven by: Economic Benefits.

Government subsidies for domestic design and factories are increased, foundry and chip revenues are concentrated in a small number of players, and price and allocation pressures are imposed. Semiconductor sales have grown by double digits, according to industry reports, and an increasing amount of design work is being funded by incentive programs and offshore engineering facilities. These trends confirm the strategic initiative to enhance ODC functions for heavy product semiconductors. Implication of Strategic Levers and ODC

The following half-decade will be the redrawing of the Global Tech Supply Chain and reinvention of the way in which Offshore Development Centers (ODCs) operate in semiconductor and electronics ecosystems. This change will be anchored on the following trends:

Corporates have to operate on three parallel sides at once: Resilience, Localisation and Capability building to navigate semiconductor geopolitics and ensure continuity within the industry being reliant on chips. Here’s how:

The design, validation, and integration of the chip into intelligent systems now define the semiconductor supply chain instead of the chip manufacturers. The strategic centre of gravity is subtly moving to offshore development centres, which are both politically neutral and heavily dependent on engineering, as geopolitics redraws global borders. Over the following five years, the automotive and electronics ODCs will become centers of efficient support and anchors of innovation engines; they will lead the development of design sovereignty, decrease reliance on unstable regions, and speed up time-to-market. The financial benefit is two-fold: reduced R&D overhead and increased innovation throughput. Semiconductor politics has, inadvertently, introduced a new era of international cooperation, one where future generations of chips, automobiles and connected objects will be designed in offshore regions, produced in many locations and controlled at a global level.

ODCs ensure availability of skilled engineers, cost-efficiency, and geopolitical neutrality, allowing businesses to keep designing their chips and developing their firmware in the wake of global trade restrictions. Due to thousands of chips per car, automotive production is affected; disruptions cause assembly lines to stop, slow EV launches, and increase the cost of components. India is growing into a major design and R&D hub thanks to initiatives like the Semicon India Programme and the Design Linked Incentive (DLI) scheme, which is attracting the interest of international chipmakers to install OCDs to design chips and embedded software. They lessen the R&D expenses by up to 30-40 per cent, shorten the product development process, facilitate extended design activities across time zones, and offer robust IP protection. Nearshoring is more resilient through its compliance and proximity advantages, whilst offshore centers are their counterparts offering scale, cost reduction, and high-quality talent in design and engineering. It is a well-built global delivery model. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

The Geopolitical starter and the knock-on effects.

Evidence Of The Shift is Presently Current

Strategic Lever

Immediate ODC Impact

Export Controls/Sanctions

Move of software/design to neutral ODCs

National Incentives (e.g., DLI)

ODCs host new chip-design projects.

Talent Availability

Accelerated silicon validation & embedded SW cycles.

Cost Arbitrage

Lower R&D burn, larger test/CI investments

Foundry Concentration

Onshore manufacturing, offsite system design.

The Future of the Next Five Years

5-Minute Playbook on corporate leaders.

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025