Global Capability Centers (GCCs) are transforming into cost-effective delivery units, and strategic places that define global business results. Recent statistics indicate that India alone has over 1,900 GCCs, and these companies add tens of billions of revenue and employ well in excess of a million professionals, which will be the imprint of where and how multinationals will find competency and command. Regulatory change serves as the catalyst and the shield of this transition: it makes non-compliance more expensive and also opens opportunity windows to those GCCs that leap first, invest in resilience and integrate regulatory smarts into their operations. This blog summarises the prevailing regulatory environment, direct effects of these changes and their impacts on the operations of the GCC, the financial benefits on the table, and a roadmap that leaders can use to transform such changes to strategic leverage.

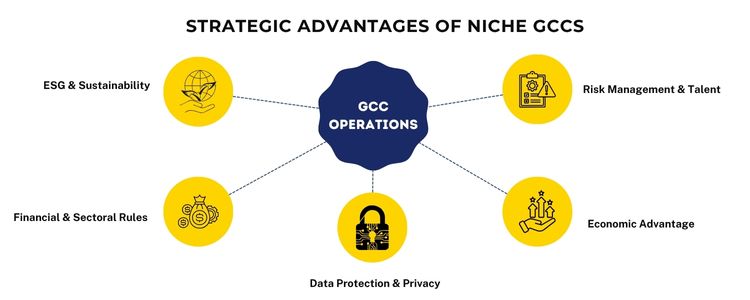

The three types of regulatory change are the most significant to GCC operations currently: Data Security and Sovereignty: The Digital Personal Data Protection (DPDP) Act, 2023 in India establishes new compliance criteria on the processing and collection of personal data, which influences the cross-border data flows and data processing levels within GCCs. Operational Guidance in Financial Sectors The revised operational risk guidance by the Reserve Bank of India (RBI) on operational risk, outsourcing, and IT services provides a higher level of controls on third-party/vendor governance and resilience requirements by financial GCCs. ESG, AI Governance, and Sectoral Regulations A requirement to disclose ESG, AI-ethics guidance, and sector regulations in healthcare, BFSI and telecom introduce vertical compliance threads that GCCs will have to spin into central processes.

There are four interrelated impacts of regulatory changes on GCC functions: Operational Compliance & Risk Management – Detailed reporting, audits and vendor due diligence cost but lessen strategic risk. Documented resilience and outspoken outsourcing matrices are what RBI and other regulators are now looking to see. Technology & Architecture — Cloud, identity and encryption architecture reconsidered due to the requirements of data localisation and data-protection laws; regtech and automation are now a procurement concern. Talent and Capability Development — The compliance, privacy engineer, and regulatory affairs specialists would become core recruits; training would be shifted towards the ongoing learning. Strategic Location and Investment – It is in open, predictable regulation that becomes a site selection advantage; GCCs in jurisdictions with consistent regulatory roadmaps bring more investment in the long term.

The expense associated with regulatory readiness is not that alone: The financial advantages explain why GCC revenues and headcount are still growing faster and faster: the most recent industry disclosure estimates the GCC revenue contribution in the tens of billions of dollars and predicts steady growth to the triple-digit billions by 2030 of the global GCC ecosystem.

Leaders must take reactive to anticipatory postures in five connected steps:

Regulatory reforms will only intensify: GCCs’ technology design, hiring decisions, and investment decisions will be influenced by data protection, operational resilience, and ESG. To the extent that GCCs perceive regulatory changes in the GCC not as a cost to comply with but as a competitive benefit, they will become more effective at international business in GCC markets, decrease long-term risks, and obtain parent company strategic work. The future lies in the GCCs’ adaptability, controllability, and willingness to take the lead.

Inductus GCC will keep you ahead of regulatory changes. Compliance systems and risk management plans and more. We ensure that businesses transform policy changes into growth opportunities. Get in touch with us today to prepare GCC operations safely and swiftly into the future.

A GCC is an offshore facility of a multinational company that undertakes niche roles such as research and development, information technology service and strategic management. It is a government program that gives the women entrepreneurs up to 1 crore in bank loans to fund greenfield projects. Personal responsibilities and unconscious bias are the factors that lead to their mid-career attrition and slow them down in their careers. They introduce new ideas, understanding, and team-oriented leadership that speeds up the advancement of such areas as AI and cybersecurity. By 2030, women are expected to take up 25-30 per cent of GCC leadership positions, which will be paramount to the growth of the Indian market. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

Regulatory Environment Transforming GCCs

Regulatory Changes on GCC Operations

Regulatory change, Immediate operational effect & Strategic action

Regulatory change

Immediate operational effect

Strategic action (GCC)

DPDP Act (data rules)

Review transfers across borders; update consent/legal basis.

Introduce DPO role, privacy-by-design, data mapping.

RBI outsourcing & resilience guidance

More stringent vendor controls and DR test requirement.

Enforce vendor SLAs, conduct operational resiliency programs.

ESG & reporting mandates

New disclosure and measurement requirements.

Develop sustainability reporting in finance & ops

Economic Benefits

Roadmap: Transforming Regulation Into Strategic Advantage

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025