India is no more a back office of the world; it is emerging as the global hub of innovation-driven Global Capability Centres (GCCs). By 2025 India has 1,900+ GCCs with close to 2 million professionals, and this is expected to grow to higher than 2,400 by 2030. The GCC market in India stands at USD 46 billion and is projected to scale to USD 110 billion by 2030 associated with a CAGR of close to 14 per cent. It is against this background that Tokyo Electron (TEL), the third-largest supplier of semiconductor manufacturing equipment worldwide, is in negotiation terms to set up a GCC in India, with Uttar Pradesh (UP) slated to be a serious contender. It is not only the market expansion but also a move to align with the government encouragement and focus on the growth of semiconductors in India as well as UP as an emerging GCC hotspot.

Tokyo Electron is a Japanese Corporation and among the three largest providers of semiconductor production equipment in the world and it has business operations in Japan, U.S., Korea, Taiwan, Europe, and China. Its operations include wafer fabrication, flat panel displays and semiconductor equipment services. One thing that makes India particularly important to Tokyo Electron in its market expansion strategy is the fact that India lacks a prominent captive centre yet it operates globally. As India emerges as an ideal location for GCCs, it will be appropriate, therefore, to set up an offshore development center in India so that TEL can scale up R&D, engineering support, and also field solutions in one of the growing semiconductor markets.

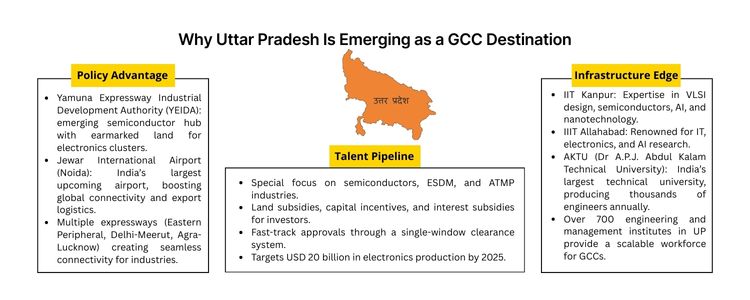

Indian states such as Karnataka, Telangana or Tamil Nadu had previously dominated the GCC landscape, but now Uttar Pradesh is also starting to position itself as a GCC destination because of: All these make UP a very desirable reason to establish the offshore development center of Tokyo Electron.

Challenges: Slow pace of execution of the infrastructure, dearth of niche semiconductor skills, and competition with other more established Gcc hubs such as Bangalore and Hyderabad. Drivers: The attraction of industries by the central government & the active industrial policy of UP, the excellent relationship with Japan in the area of technology and advanced cooperation with academic institutions on special training.

A Tokyo Electron GCC in UP has the potential to be a milestone in the semiconductor GCC of India. It would not only generate high-value jobs, but it would also make UP the location of semiconductor innovation and R&D. Such a move can spur other OEMs and Japanese semiconductor firms to follow their suit, shifting the semiconductor global supply chain to India. As GCC 3.0 becomes a centre of innovation, the roles of India are changing to partner in technology development for global markets.

The development plan by Tokyo Electron to set up a GCC in India, with Uttar Pradesh as a leading contender, is an indicator of a new growth path in India in the GCC sector. It throws light on the process of India converting itself to a strategic innovation partner in the semiconductor ecosystem rather than being a cost-efficient outsourcing provider. Strong policy commitment, a skilled labour force and a rapidly growing electronics value chain mean that UP can be the new frontier of the global capability centres. To companies, this is an indication that India no longer remains an alternative but a destination of the future, and in particular UP.

Interested in establishing or expanding your Global Capability Centre in India? At Inductus GCC, we deliver the full picture of GCC advisory, including strategy and location selection as well as talent administration and operational excellence. Work with us to discover Uttar Pradesh as a GCC destination and make your success story in the world.

A GDC refers to a single-minded offshore deployment, which provides proficient business, technology and operational services to corporate bodies on a global basis. BFSI, IT services, healthcare, telecom, retail, manufacturing, and other upcoming technologies, including AI and blockchain. They do not only target cost savings but now aim at innovation, automation, R&D, digital transformation, and high-value consulting. They design and create cloud, artificial intelligence, analytics, cloud security, and process automation. A large supply of STEM graduates, multilingual workers and niche skills in AI, ML, cloud, and analytics. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

Tokyo Electron Global Presence

Why is Uttar Pradesh in Market?

Strategic Value of a Tokyo Electron GCC in UP

Area

Strategic Value

Semiconductor Ecosystem

Strengthens India’s fabless design & supply chain capabilities.

Talent Development

Upskills engineers in advanced chip design and process automation.

Global Linkages

Connects India’s GCCs to Japan’s semiconductor supply chains.

Policy Synergy

Aligns with India’s Make in India & Digital UP initiatives.

Economic Impact

Generates high-value jobs, boosts exports, and nurtures local vendors.

Challenges

Future Outlook

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025