Over the next ten years, managing climate shocks and feeding the growing population will require more intelligent, data-driven farming rather than more acres of land. Agritech sensors, satellites, predictive AI, robotics and cloud platforms are already growing exponentially: analysts believe that the agritech market will grow more than 2x over the coming five years with aggressive CAGR forecasts through 2030. This expansion goes hand in hand with strong capital inflows toward agri-foodtech and an explosion of capability centres that can consolidate talent, scale and domain experience where innovation can proceed most rapidly.

Global Capability Centres (GCCs) have outgrown their back-office functions to take the form of R&D and product centres. India is home to most of the GCCs in the world, approximately 1,900 centres, which collectively yield significant revenue and millions of jobs and are instinctive sources of agritech innovation and scale delivery. A single location where models, platforms, and farmer-facing services are rapidly iterated is created by locating agritech engineering, data science, and cloud teams within GCCs.

GCCs boost the adoption by integrating engineering scale and domain experts. GCCs digitise food security through the five strategic pillars below. These pillars are micro-economies: GCCs reduce unit costs of R&D, reduce time-to-market of software and enable players on a global scale to conduct 24/7 development lifecycles and retain domain teams near end-users.

The urgency is pointed out by the market and funding trends. Despite shifts in investment reallocating capital across maturity levels, agri-foodtech is also attracting significant capital, and the forecasts for the agritech market indicate high growth in the mid-to-late decade due to the expansion of precision and cloud services. Meanwhile, the GCC growth is a source of concentrated economic value, the export revenue, skilled employment and cost arbitrage that companies reinvest into localised research and development. These forces are combined to reduce the per-farmer cost of high-tech services and make deployment schedules of climate-proofing provisions compressible.

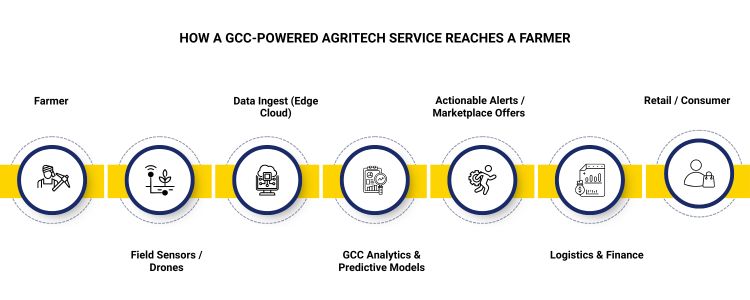

This brief chain highlights GCCs’ role as the analytics and integration platform that turns raw data into choices, goods, and value.

Governments and development banks in Asia, Europe and Africa are investing in climate-smart initiatives and expanding digital agriculture programmes, a needed complement to individual GCC activities. GCC multinational agribusinesses already run simulation labs and pilot farms to test autonomous machinery, seed-performance models, and cold-chain telemetry before expanding internationally. Climate-smart agriculture programmes are also gaining access to public finance and concessional capital, which is consistent with incentives to deploy at rapid speed.

In the future, GCCs will help agritech to be modular and affordable all over the world. Crop digital twins, remote-controlled mechanisation, and financing of the marketplace will move the yield curve upwards without a corresponding increase in land. To the companies and governments, the economic benefits are obvious: reduced costs of R&D, shorter iteration cycles, exportable platforms and quantifiable post-harvest losses, all of which bolster national food security and rural economies.

Digitising food security is not a technology project but is a systems effort. GCCs are providing the concentrated talent, cloud infrastructure, and product rigour needed to turn sensors and models into stable markets, robust supply chains, and farmer incomes. If food security is the goal, Agritech GCCs are the infrastructure that will probably get us there more quickly, more affordably, and with greater accuracy.

Hyderabad, Bangalore and Pune have become significant pharma innovation centres with global delivery centres of major biotechnological and pharmaceutical firms such as Novartis, Pfizer, AstraZeneca and GSK. They offer an economic benefit of calculation, a variety of scientific and technical human resources, and speedy time-to-market. On average, businesses reduce between 25-40 percent of the operational costs and increase the rate of innovation. The next-generation operations of Pharma GCC focus on advanced molecular modelling, AI/ML-based drug discovery, cloud supercomputing, and data integration platforms, as well as quantum-ready simulations. Pharma GCCs use AI to screen molecules, predict the efficacy of drugs, optimise clinical trials and aid in making data-driven decisions, resulting in smarter, faster and safer drug pipelines. Pharma GCCs will be global innovation ecosystems that are a combination of computational chemistry, generative AI, and quantum computing. They will turn into the hubs linking data science, discovery and regulatory intelligence in the global arena. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

Why Agritech GCCs Matter Now

Five Pillars Motivated By GCCs.

What The Statistics Tell

Strategic Powers Table

Strategic Power

What it delivers for food security

Predictive AI & Models

Early warning; minimised yield losses.

IoT & Edge Devices

Reduced wastage; efficient utilisation of resources.

Traceability Platforms

Safer exports; premium pricing

Cloud APIs & Interoperability

Faster partner integration

Finance & Insurance Tech

Enhanced investment and uptake by the farmers

The Real-Life Examples and Policy Context

The Future

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- Pharma GCC Setup Services in India: Strategic Considerations for CXOs January 9, 2026

- Why Enterprises Are Rethinking Their GCC Strategies in 2026 January 8, 2026

- Why Most Enterprise Expansion Strategies Fall Short of Projections, And How a GCC Enabler Can Bridge the Gap January 7, 2026

- India’s GCC Ecosystem: Why the World’s Biggest Companies Are Betting Their Future on it January 3, 2026

- Healthcare GCCs in India: Where the World’s Pharmaceutical Innovation Actually Happens January 2, 2026

- Circular Economy Models and Their Relevance to Manufacturing GCCs December 30, 2025

- GCCs in Agritech: Digitizing Global Food Security December 29, 2025

- Renewable Energy GCCs: Accelerating Global Green-Tech Development December 29, 2025

- Cyber Resilience 2030: Multi-Layer Security Architecture for GCCs December 26, 2025

- Building an Integrated Risk Management Framework for Multi-Region GCCs December 26, 2025

- The Ethics of Automation: How GCCs Maintain Human Oversight in AI Workflows December 25, 2025

- Future of HR in GCCs: Data-Led, Skills-Based, and GenAI-Driven December 25, 2025

- The Proposal to Standardize India’s GCCs for Unshakeable Global Leadership December 24, 2025

- Global Capability Centers: A Strategic Growth Model for B2B Enterprises December 24, 2025

- AI Ethics & Compliance Mandates for GCC Operations in 2025 December 23, 2025