In the new world of digital banking, global financial institutions are under heavy pressure to enhance innovation to reduce costs and to follow the rules of the UK and Switzerland. This change is not just operational; It is also strategic. To amidst this change, India’s Global Capability Centre (GCC) has evolved into strategic centers that strengthen this reconstruction.

Today, more than 45% of global banking and insurance companies operate advanced GCCs from India. According to a 2024 report, India has added over 160 new BFSI-centric GCCs in the last three years, leading to an increase of 23% in the financial GCC.

What is the reason for this change? A rare combination of digital capacity, depth of the financial sector, and economic benefits:

- India’s BFSI technical workforce is more than 21 lakhs, which provides talent at 30–40% lower cost than Western Europe.

- The Indian GCC market crossed $46 billion in FY 2024, with BFSI’s contribution at 38%.

- The average British bank saves $65-80 million annually by transferring its main platform to India-based GCC.

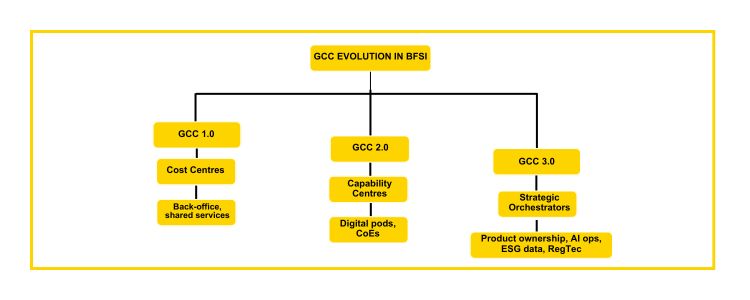

This is no longer about the back-office support—it is a strategic commercial reconstruction led by GCC 3.0.

GCCs are no longer about support; they are about solving business problems in real time. What are the targets set with the next generation GCC operating models in India and Switzerland’s financial institutions? India:

| Vision Objective |

Strategic Goal |

| Digital Reinvention |

Automate and modernise legacy banking operations. |

| Risk & Compliance Control |

Address UK-EU divergence and Basel IV complexities |

| Faster Innovation Cycles |

Roll out FinTech-style products in 3–6 months. |

| Data-First Decisioning |

Build customer intelligence models using AI and synthetic data. |

| Operational Resilience |

24×7 delivery via cloud-native and distributed GCC structures. |

These goals are only possible with a reliable partner like a GCC consulting firm in India, which brings both BFSI knowledge and digital implementation.

The British and Swiss banks are no longer looking for just support to India, but they are also looking towards construction, change, and leadership here.The next chapter of financial services requires speed, innovation, compliance, and intelligence. India’s GCC services provide all this fast and on a large scale.

Inductus GCC is a reliable GCC consulting firm in India, we help global banks imagine, design, and operate their next generation of operating models—inhalation, securely, and for the future.

frequently asked questions (FAQs)

1.

Why should we include a GCC counselling firm?

They bring local expertise, regulatory guidance, seller access, and proven models to reduce risk and speed up setup and ROI.

2.

What services do GCC advisory firms generally provide?

Services include location strategy, regulatory compliance, operational model design, vendor ecosystem setup, talent sourcing, and transition management.

3.

How long does it take to install GCC with an advisory firm?

With specialist guidance, companies can start a functional GCC within 4-6 months based on complexity and scale.

4.

Are India's Tier-2 cities suitable for GCC?

Yes. Many Tier 2 cities like Indore, Coimbatore, and Bhubaneswar provide cost profit, strong talent pools, and better infrastructure, which makes them suitable for GCC.

5.

How do I choose the right GCC advisory partner?

You should have to look for firms with India’s market expertise, industry-specific knowledge, a strong sellers network, and proven GCC setup experience.

Aditi

Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.