The distinction between a Global Capability Centre (GCC) as a strategic growth engine and a commoditised offshore development centre is made during the first three years. In India, there are nearly 1,900+ GCCs with an annual revenue of about USD 65 billion in 2025 and they employ nearly 1.9 million professionals. This is a sharp increase in the captives’ growth, and it is a clear indication that captives are growing beyond cost arbitrage. However, growth comes with its own contradiction year by year. Three more captives have crossed a quiet plateau, and operations move smoothly, but no strategic effect is felt. The solution is not accidental; it is a related GCC Transformation Strategy that transforms cost centres into capability hubs. A sharp, innovation-focused roadmap of leaders who will not allow three years to become the dormancy year is outlined below.

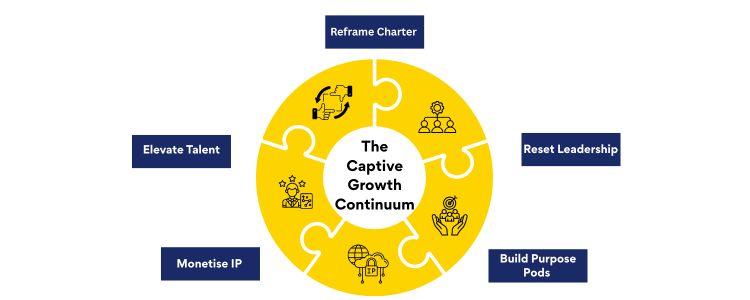

These plays supplement each other. They form a consistent Captive Centers Strategy.

GCCs are collaborating with start-ups, spinning off internal venture laboratories, and synchronising flows of Zero-Based Budgeting to invest savings in automation and GenAI. It’s a decisive shift in favour of strategic differentiation over simply optimising GCC Cost efficiency.

The ability to operate, team rotation, centring pods, monetisation of IP and talent mobility, and the Captive Centers Strategy make the silent crisis a launchpad. The targets are strategic and economic prisoners who will be the ones creating tomorrow’s enterprise playbook if they survive.

Hyderabad, Bangalore and Pune have become significant pharma innovation centres with global delivery centres of major biotechnological and pharmaceutical firms such as Novartis, Pfizer, AstraZeneca and GSK. They offer an economic benefit of calculation, a variety of scientific and technical human resources, and speedy time-to-market. On average, businesses reduce between 25-40 percent of the operational costs and increase the rate of innovation. The next-generation operations of Pharma GCC focus on advanced molecular modelling, AI/ML-based drug discovery, cloud supercomputing, and data integration platforms, as well as quantum-ready simulations. Pharma GCCs use AI to screen molecules, predict the efficacy of drugs, optimise clinical trials and aid in making data-driven decisions, resulting in smarter, faster and safer drug pipelines. Pharma GCCs will be global innovation ecosystems that are a combination of computational chemistry, generative AI, and quantum computing. They will turn into the hubs linking data science, discovery and regulatory intelligence in the global arena. Aditi, with a strong background in forensic science and biotechnology, brings an innovative scientific perspective to her work. Her expertise spans research, analytics, and strategic advisory in consulting and GCC environments. She has published numerous research papers and articles. A versatile writer in both technical and creative domains, Aditi excels at translating complex subjects into compelling insights. Which she aligns seamlessly with consulting, advisory domain, and GCC operations. Her ability to bridge science, business, and storytelling positions her as a strategic thinker who can drive data-informed decision-making.

Why Three Years Is Not The Limit, But Rather The Inflection?

Five Strategic Plays

Strategic Plays → Actions → Leading KPIs

Strategic Play

Immediate Action (90 days)

Leading KPI (6–12 months)

Reframe Charter

Redistribute 25% of the budget to outcome pilots

Number of outcome pilots having a P&L impact.

Reset Leadership

Assign HQ rotation programme

% executive engagement in roadmap

Purpose Pods

Stand up 3 pods with sprint cycles

Time-to-first-PoC (weeks)

Monetise IP

Catalogue reusable assets

Internal licensing events

Talent Maturity

6-month reskill bootcamps

% promoted to global roles

Economic Benefits

Signs of Risks

Progressive Captives Are Right

Conclusion

frequently asked questions (FAQs)

Aditi

Hey, like this? Why not share it with a buddy?

Related Posts

Recent Blog / Post

- The Green GCC Framework: Carbon Neutral by Design December 11, 2025

- Data Residency, Privacy, and Global Governance Challenges in GCCs December 11, 2025

- Applying Zero-Based Budgeting (ZBB) for Next-Gen GCC Cost Optimisation. December 10, 2025

- The Silent Crisis: Strategic Plays for Captive Centers to Avoid the ‘Year Three Plateau’ December 10, 2025

- Why Emotional Intelligence Is a Must-Have Competency in GCC Leaders December 10, 2025

- Bridging the Trust Gap: Unlocking European GCC Potential in India December 10, 2025

- The Telecom GCC Innovation Centre’s Role in Global 5G/6G Network Virtualisation. December 8, 2025

- Managing ITAR and Export Controls: The High-Security Mandate for Defence Captive Centers December 8, 2025

- Policy and the Multi-City GCC Grid: Catalyzing India’s Next Wave of Global Capability December 6, 2025

- BFSI GCC Digital Transformation: Moving from Back Office to Front-Line FinTech Innovation. December 6, 2025

- Pharma Global Capability Centers: Accelerating Drug Discovery with Computational Chemistry December 6, 2025

- ‘Capability’ and ‘Sustainability’ as the New Twin Drivers of GCC 3.0 December 4, 2025

- Beyond Cost: Using Value-Per-Employee (VPE) as the New Metric for GCC Cost Optimisation. December 3, 2025

- From Cost Arbitrage to Global Chip Architect: Securing India’s Tech Future December 2, 2025

- The Great Reskilling Challenge: Preparing the Workforce for GCC Digital Transformation by 2025 December 2, 2025